Who needs financial aid the most?

With the rapidly rising costs of college, students are scrambling to obtain scholarships and financial aid money that will help them subset the costs of their student loan debts.

Even with institutional grants, scholarships and federal grants (including work-study), several students in the United States are struggling to find the means of making up the difference in college tuition (and of far away room and board costs).

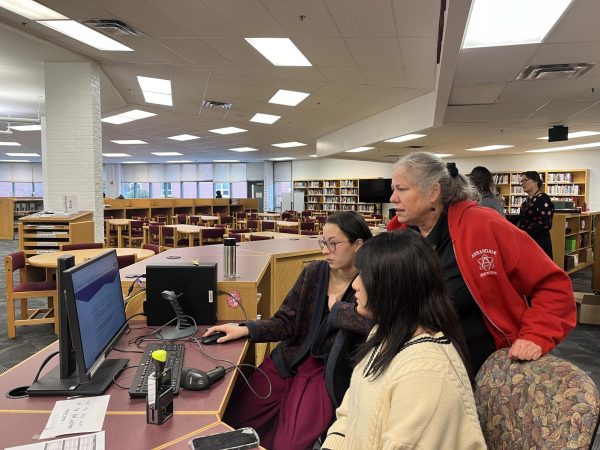

Especially at AHS, where more than half of the students are on free and reduced lunch, many students have the tough decision of choosing a college based on the total aid package offered from each individual school.

But how do students manage to receive aid in the first place? Several universities and institutions utilize the Free Application for Federal Student Aid (FAFSA), using the Federal Methodology to determine student financial aid based on income.

In addition to the FAFSA, another commonly used form by more selective private colleges is called the College Scholarship Service Profile (CSS Profile) created by the College Board (who also administer the commonly dreaded SATs).

The CSS uses Institutional Methodology and is much more detailed in terms of acknowledging more about financial status, including but not limited to student and parent debt, retirement account finances and home equity.

In regards to the “Institutional Methodology” aspect to the Profile, there is a general CSS application in addition to more questions that different universities may have regarding your finances, thus catering to the term “institutional.”

The final goal for these financial aid forms is to determine the Expected Family Contribution that universities use to determine how much need-based scholarships, grants and perhaps work-study that you are qualified for.

But is the Expected Family Contribution true to the financial need of students? During the college application season, I had also applied to both FAFSA and CSS, inputting my parent’s income and financial situation.

Coming from a household comprised of two engineers, whose combined income is considered to cover the total costs of all universities that I applied to, I was not given any federal grants, but instead offered a Federal Direct Unsubsidized Loan of $5,500 (also called a Stafford Loan).

Compared to the Federal Direct Subsidized Loan, if I accepted this loan, I would be responsible for paying the interest (the U.S. Department of Education pays for the interest on the Unsubsidized Loan) that can accumulate if I choose to defer my payments until after I graduate from university.

Being the oldest in the family of two children, and also being the first going to college, I was not considered “needy” as deemed by the different methodologies that take into consideration family household size, and if other children in the family currently attend college.

However, I’m not expecting nor do I want that my parents cover any costs for my college education. With my Expected Family Contribution being approximately $12,000 greater than the highest total cost for one of the colleges I applied to, I’m considered to have all finances in check.

Despite this misleading view of having total financial security, there is actually more financial dependence. So my household income is considered to be a little greater than what is considered to be average in the United States? It is still considered to be average, or even lower compared to the totality of the working-class residents in the Northern Virginia region.

That doesn’t mean that other students whose parents make a little more than the average income will be living so well off. Compared to the different areas within Virginia that students come from, the cost of living can vary drastically, especially from south to north. There are many different factors that financial aid forms do not take into consideration, factors that can’t be filled in on an application online.

Not having the resources for financial security is one thing and being deemed as “needy” by the FAFSA and CSS forms is another. On the topic of not having resources, many students have parents whose jobs allow them to offset balances in terms of finances.

Take into account taxi drivers, who typically have physical cash being given to them. Paper money is harder to track, and thus the students can input a lower value for that parent’s income eventually leading to a lower Expected Family Contribution and greater federal financial aid!

Alternatively, let’s take for example ethnicity-based scholarships and grants. At a particular university, applicants can be awarded scholarships simply if their ethnicity is considered to be part of the minority within the university.

This is great, but these can be rewarded without a glance at the financial circumstance of the applicant, which makes it easier for those who actually have the money to invest into their college education to obtain those awards.

Now let’s look at the academic part of the equation. Academics are a great way for students to receive free money for college. However, some colleges may not reward this to everyone, even if they are all straight-A-receiving IB students.

According to www.collegedata.com, George Mason University offered merit-based gifts to 3.3 percent of their incoming freshmen that had no financial need for the 2012-13 school year.

Some colleges that AHS students eventually attend include George Mason University, James Madison University, Virginia Tech and Virginia Commonwealth University.

The current in-state cost of attendance for these universities are: $25,240, $23,530, $23,941 and $24,905 respectively. The percentage of need being met are: 62 percent, 41 percent, 60 percent and 59 percent respectively.

Looking at the total cost of attendance for each university, with the highest percentage of need being fully met at 62 percent, many of the students still struggle with affording and paying for the costs that attending college brings.

What needs to happen? A change in the U.S. education system. There needs to be an extreme emphasis on changing the financial aid system to account for the rapidly increasing costs of college.

Financial aid needs to be distributed appropriately so that the next generation can focus on making the world a better place instead of becoming slaves to crippling college debt.

Aniqa is a staff writer for the A-Blast and a senior at AHS. She is a member of the Green Atoms, NHS, MHS, NEHS and other activities. She also serves as...