Cheap gas is a mixed blessing

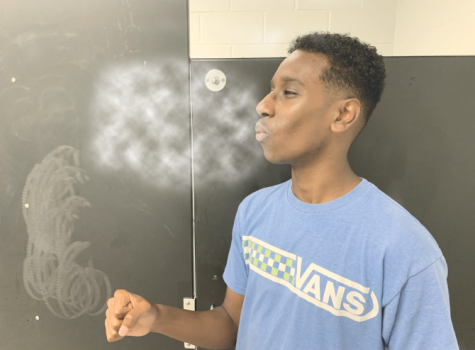

Gas prices have been at historically low levels for a number of months, generally hovering around $1.50 a gallon, and AHS students that drive have been reaping the benefits. One of the students enjoying cheap gas is senior Michael Ryan.

“If I don’t drive, I don’t get to school, I don’t get to my academy class, and I don’t go home,” Ryan said. “It used to cost my sister $80 to fill up a tank, but it costs me $20. It’s great.”

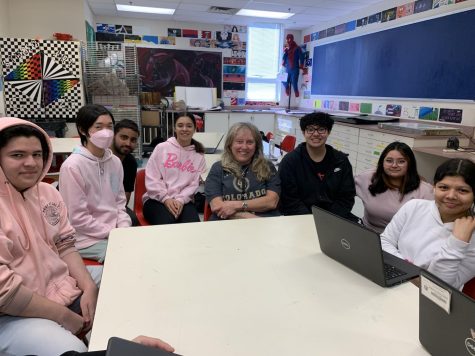

While cheaper gas makes life easier for students, it can be a godsend for teachers. Teachers bear the full financial burden of their commutes, and while distances and fuel consumption may vary, cheaper gas is always appreciated. For Photography teacher Meredith Stevens, who has a 106 mile commute from Fauquier County, savings on gas for her Mazda 3 translate into money that can be spent elsewhere.

“I always budget for [gas prices], so the prices don’t have as much of an impact,” Stevens said. “But cheaper gas might mean we go out to eat more, my son might get an extra toy, or we might get to do more [activities] with my son. We always take necessities into account, but we definitely have more discretionary income.”

AHS teachers and students are not the only ones who appreciate savings at the pump. According to NPR, cheaper gas is typically associated with accelerated economic growth. Savings at the pump let consumers spend, save, or invest money they otherwise would be spending on gas, spurring economic growth. However, the specifics surrounding this particular drop in gas prices casts a shadow on hopes of rapid domestic or international economic growth. The oil market is oversaturated, and a number of political developments throughout the world threaten to worsen the oil glut.

As with every free market, supply and demand drives the price of gas up and down. At the moment, there is an incredibly large supply, and a declining rate of consumption from countries such as China and the United States. That said, the specifics surrounding the entire situation are far from simplistic. The oversaturation of the oil market is the result of a number of political, economic, and technological developments throughout the international community.

Crude practices

The oversaturation of the oil market can be pinned on two main perpetrators: overproducing OPEC nations, and the shale oil boom in the United States. OPEC, The Organization of the Petroleum Exporting Countries, is a coalition of oil-rich Middle Eastern, South American and African nations that work to “coordinate and unify petroleum policies between member nations. In normal circumstances, this “coordination” ensures that no single oil-rich nation is capable of destabilizing the international oil market, as well as assisting other member nations that might be suffering. That said, a cursory look at the affairs of member nations, such as Venezuela, indicate that OPEC may be failing to deliver on their mission statement.

Venezuela is a South American nation that is highly dependent on oil exports to sustain its economy. The rapid reduction in oil prices have led to a significant downturn in the Venezuelan economy. NPR reports that unemployment is widespread, and many necessities are both expensive, and scarce. Additionally, the International Monetary Fund (IMF) is expecting Venezuela’s inflation rate to reach 720 percent this year.

Venezuela is not the only OPEC nation that is suffering. NPR reports that Saudi Arabia, has announced that its 2016 budget will involve numerous spending cuts, changes to energy subsidies and a renewed push for wider taxation and privatization of industry. According to Topics teacher Jonathan York, greater taxation and spending cuts could be an uncomfortable transition for Saudi Arabians.

“In Saudi Arabia, 90 percent of the people have government jobs,” York said. “Saudi Arabians rely on the government for financial and social stability, and now the government is cutting back on social programs.”

In an attempt to stabilize the market, Saudi Arabia, Russia and other oil-producing nations have agreed to stop ramping up oil production in the hopes that demand eventually catches up with the available supply. However, not every oil-producing nation has agreed to “freeze” production. Reuters reports that Iran, recently freed from sanctions and eager to expand its economy, has announced that it plans to double its oil exports in the coming months.

Iran is not the only one that has intentions of further saturating the oil market. The United States is also responsible, and according to speculation from the BBC and the Wall Street Journal, may be the reason why OPEC nations have refused to lower their production levels.

Severe Shale Storms

The United States has long been working to reduce its dependence on foreign oil for its energy needs. Shale oil is an important step forward in that endeavor. According to the U.S. government, shale oil is produced from rocks made of prehistoric silt and organic material. Though the process is more complicated and expensive than conventional oil drilling, the U.S. has some of the largest shale deposits in the world, making shale oil an attractive prospect for a nation that is trying to become more energy-independent.

The rapid expansion of shale oil drilling has massively increased U.S. oil production, but is also largely responsible for the rapid decline of oil prices seen today. U.S. shale oil producers have flooded a market that was already swimming in OPEC oil, and demand has not risen to match the supply.

The BBC reports that OPEC’s decision not to reduce oil production has been an attempt to reduce U.S. shale oil production. Since shale oil is significantly more expensive to process than crude oil, the current oil prices make it impossible for U.S. companies invested in shale oil production to turn a profit. While shale production has decreased slightly, the BBC reports that the drop in production is nowhere near enough to offset the oversaturation of the oil market. By all indications, oil prices are likely to remain the same unless U.S. shale oil production rapidly declines, or if OPEC nations decide to reduce their production of crude oil.

What it means for the consumer

For the immediate future, American drivers will continue to buy gas at less than $2 a gallon. These savings translate into more discretionary income, or more money to put towards a savings account of larger purchase. However, the long term effects of cheaper gas may become clear to the average consumer in time. York believes gas prices have a major effect on retirement plans and savings plans that center around “safe” investments.

“The lower gas prices hurt your retirement plans,” York said. “You’re invested in [oil companies], and the stock market reacts negatively to drops in gas prices.”

Though retirement plans and energy investments may be suffering, consumers generally stand to gain from lower oil prices. Cheaper gas means more money available to spend, save, or invest. NPR reports that many Americans are opting to save the money that would have otherwise been spent on the pump, instead of spending it. This is likely because of lessons learned during the housing market crash. While saving is a sound decision on an individual level, it does little to spur broader economic development or expansion.

That said, shale oil production is operating at a net financial loss. A shale oil crash could cause a significant number of job losses, but as of now, the majority of shale oil industry is still stable. The American Energy Information Administration has reported that shale oil production has only seen modest reductions. While NPR reports that a number of American oil companies, mainly ExxonMobil, are posting severe drops in profitability, many of these companies have large cash reserves set aside to weather through long periods of high operating costs and low profits. A complete collapse of shale oil production is unlikely.

For the time being, it appears U.S. oil producers and OPEC nations are at an impasse. Current supply levels still far outweigh the demand, but neither side is willing to reduce their production of oil. Until one side does something to significantly alter the available supply of oil, consumers can expect gas prices to remain more or less the same.

Nicholas Mortensen is a senior at Annandale High School and is a first-year staff writer at the A-Blast. Nicholas is an IB Diploma candidate, and is a...